If you’re an importer—especially if you’re new to international trade—you’ve probably come across CIF shipping. But do you fully understand what it means and how it affects your costs and responsibilities?

This guide will walk you through everything you need to know about CIF (Cost, Insurance, and Freight) shipping in 2025. By the end, you’ll know whether CIF is the right shipping term for your business and how it compares to other options like FOB.

📌 Key Takeaways at a Glance

✅ CIF (Cost, Insurance, and Freight) is an Incoterm where the seller covers shipping, insurance, and freight to your port.

✅ Best for new importers who want the seller to handle logistics.

✅ More expensive than FOB because sellers add extra charges to the freight cost.

✅ Risk transfers at destination port, meaning you handle customs and inland transport.

✅ FOB gives you more control, but CIF is easier for beginners.

1. What is CIF?

CIF stands for Cost, Insurance, and Freight. It’s one of the most commonly used Incoterms (International Commercial Terms) set by the International Chamber of Commerce (ICC) to regulate shipping responsibilities between buyers and sellers.

When you purchase goods under CIF terms, the seller is responsible for:

- Export customs clearance

- Freight and insurance costs

- Transporting goods to your destination port

However, once the shipment arrives at your port, the responsibility shifts to you. You’ll need to handle customs clearance, import duties, and inland transport.

Key point: CIF only applies to ocean freight and is not suitable for air or land shipping.

2. Why Choose CIF for Importing?

If you’re new to importing, CIF can seem like a convenient option. Here’s why:

✅ No need to arrange freight – The seller handles shipping logistics.

✅ Easier for small shipments – You don’t have to deal with freight forwarders.

✅ Less hassle with paperwork – The seller arranges insurance and documentation.

But there’s a downside:

❌ Higher costs – Sellers often inflate freight and insurance costs for extra profit.

❌ Limited control – You rely on the seller’s freight forwarder, which can lead to delays.

❌ Potential hidden fees – Additional port charges may apply once the goods arrive.

Verdict: CIF is best for first-time importers or small shipments. But for larger orders, you might save money with other options like FOB.

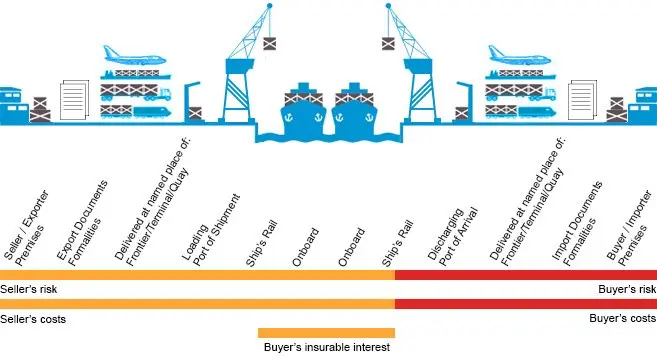

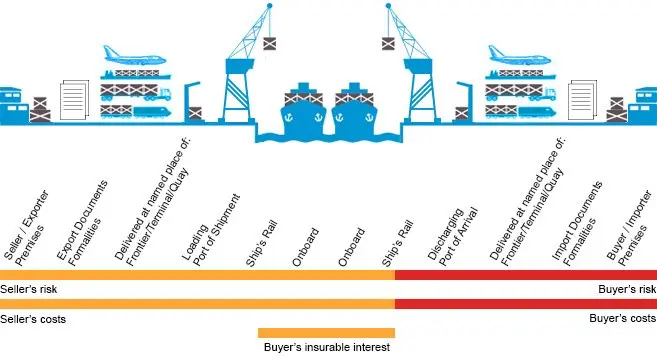

3. CIF Seller vs. Buyer Responsibilities

Before choosing CIF, you need to understand your obligations as a buyer versus what the seller must do.

Seller’s Responsibilities Under CIF:

✅ Handle export customs clearance

✅ Pay freight and insurance costs

✅ Deliver goods to the port of destination

✅ Provide shipping and insurance documents

Buyer’s Responsibilities Under CIF:

✅ Pay for import customs clearance and duties

✅ Cover inland transport from the destination port

✅ Handle additional port and unloading fees

✅ Assume all risks after the shipment arrives

Once the goods reach your port, the seller’s responsibility ends, and you must take over.

4. CIF vs. FOB – Which is Better for Importers?

Many experienced importers prefer FOB (Free on Board) over CIF. Here’s why:

FOB (Free on Board) vs. CIF (Cost, Insurance, and Freight)

| Feature | FOB | CIF |

|---|---|---|

| Who arranges freight? | Buyer | Seller |

| Who pays for insurance? | Buyer | Seller |

| Risk transfer | At origin port | At destination port |

| Cost control | More control | Higher costs |

| Recommended for | Experienced importers | New importers |

With FOB, you can choose your own freight forwarder, negotiate shipping rates, and avoid hidden costs.

With CIF, you rely on the seller’s choice of carrier, which means less transparency and higher costs.

🚀 Pro Tip: If you import frequently and want to save money, go with FOB. But if you’re new and need an easy option, CIF works fine.

5. CIF Costs: How Are They Calculated?

Wondering how CIF costs are determined? Use this simple formula:

CIF Price = Goods Value + Freight Costs + Insurance Costs

💡 Example:

If you buy $10,000 worth of goods from China:

- Freight cost = $1,500

- Insurance cost = $200

Your total CIF cost = $11,700

Customs duties are usually calculated based on the CIF price, meaning you’ll pay import tax on freight and insurance costs too!

6. CIF Risk and Insurance – What You Need to Know

Under CIF, the seller provides basic insurance (usually only 110% of the invoice value). However, this may not fully cover potential losses.

🚨 Warning:

If your shipment gets damaged in transit, you’ll have to deal with the seller’s insurance company—which can be slow and complicated.

To avoid risks, consider buying additional insurance from your own freight forwarder.

7. Common CIF Shipping Mistakes (and How to Avoid Them)

🚫 Mistake #1: Assuming CIF is the cheapest option

✅ Solution: Get a quote for FOB and compare costs.

🚫 Mistake #2: Not checking insurance coverage

✅ Solution: Ask for full insurance details and consider extra coverage.

🚫 Mistake #3: Ignoring destination port fees

✅ Solution: Check port charges before shipping to avoid surprises.

8. Should You Use CIF for Imports from China?

It depends! Here’s when CIF is a good choice:

✅ If you don’t want to deal with freight arrangements

✅ If your shipment is small

✅ If you’re new to importing

And here’s when FOB is better:

✅ If you import large volumes

✅ If you want full cost control

✅ If you have an experienced freight forwarder

9. Conclusion: Is CIF Right for You?

CIF is a convenient option for first-time importers, but it comes at a cost. While it simplifies shipping, it can be expensive and limit your control over freight.

If you’re serious about cutting costs and having better control, consider FOB instead. However, if you prefer a hassle-free solution, CIF might be the right fit for you.

📢 Final Tip: If you’re unsure whether to use CIF or FOB, work with a reliable freight forwarder who can help you compare options and find the best deal.

📞 Need help with your shipping? Contact a trusted freight forwarder today and get the best rates for your import needs!